A record number of people have enrolled in health insurance coverage through the Affordable Care Act. During the 2024 Open Enrollment Period, more than 21 million people[1] selected a health plan through one of the 19 State-Based Marketplaces (SBMs) and the federal marketplace, marking a significant increase from the previous year.

With so many Americans going to their state-based marketplace for their 2024 coverage, some states are considering (and even planning) to establish their own SBM. Under the Affordable Care Act, states must either operate their own SBM or use the federal marketplace. Currently, 32 states use the federal marketplace and 18 states and the District of Columbia operate their own eligibility and enrollment platform or SBM.

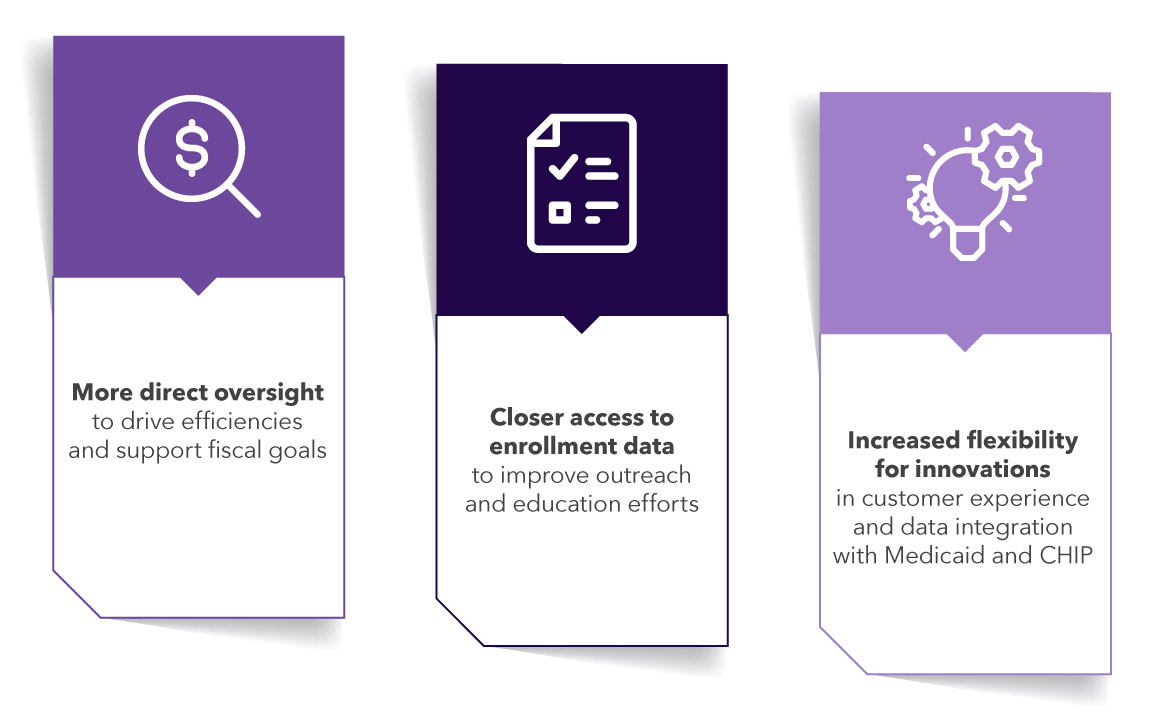

What drives these states to consider joining the other 19 with independent SBMs? For starters, greater authority and control.

For states contemplating the move to an SBM, here are five essential considerations for a successful transition:

Procure customer service and technology solutions independently

- Allow vendors to focus solely on their area of expertise while still ensuring technology and service solutions can work together. Customer service vendors excel at providing consumer-centric solutions that optimize for speed and customer support. Make sure you select one that has the proper basis of knowledge and demonstrated experience.

Meet or exceed the user's expectations

- Deliver superior customer service experience through a well-run customer contact center. Contract with proven vendors that bring you demonstrated experience in analyzing historical trends, identifying potential call drivers, and accurately forecasting call/chat volumes to manage seasonality and fluctuations in staffing levels—and have the technological and operational capacity to quickly scale (up and down) in response.

- Ensure customer service representatives (CSRs) are properly trained with skillsets that include empathy, a dedication to providing excellent customer service, and technical and policy awareness. Require the inclusion of bilingual CSRs and professional interpretation services to match the diverse needs of the people in your state.

- Ensure all customer services are accessible to all people. While the accessibility of a SBM website is generally the responsibility of the state’s technology vendor, your customer assistance vendor plays an equally critical role.

Establish systems that allow for efficient coordination between programs

- Bring the “no wrong door” approach to government service provision to your SBM. The unwinding of the Medicaid continuous enrollment provision has highlighted the need for disenrolled people to enroll in other health insurance coverage, quickly and seamlessly. An SBM that supports consumers — regardless of the initial plan they sought — helps minimize the number of people who fall through the cracks.

Commit to eligibility modernization

- Adopt a modernized consumer application approach that allows for more accurate, timely, and efficient eligibility determinations. Select a vendor that brings a proven combination of resources and technology to scan, upload and extract data, manually confirm, and match data to an existing record — as well as demonstrated experience conducting outreach for missing or incomplete information.

Invest in a marketing strategy alongside outreach and education efforts

- Diverse populations interact with SBMs. They bring different understanding, motivations, and previous experience with health insurance. They have varying education levels, language needs, and cultural considerations that influence how they perceive and comprehend health insurance.

- Select a customer service vendor with demonstrated outreach and education strategies that reach everyone—including those who are chronically uninsured or face multiple barriers. Make sure they have proven experience in the strategic use of advertising and social media to communicate important program changes and enrollment deadlines.

With the right investments, carefully coordinated efforts to increase coverage, and an ongoing commitment to consumers, states can successfully make the transition to SBMs, shaping the future of consumer-centric marketplaces where people can access quality, affordable health insurance coverage to improve overall health outcomes.

View additional insights and information on how Maximus is guiding states through a seamless transition to a state-based marketplace.